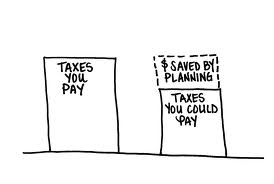

Not to beat a dead horse, but if you wait until after year-end, your options become really limited.

So, what are some simple things you can do NOW before we hit 2014 to reduce your taxes? Here are some simple suggestions:

1. Prepay state income tax owed – 9 times out of 10 this will give you a federal tax deduction, if you are not subject to AMT

2. Prepay real estate taxes – same as above

3. Put as much as you can into retirement plans – these are company plans you are in. Fully fund these if possible

4. Buy fixed assets in your business – fixed assets are big things, like equipment, cars, trucks, computers, etc. BUT, only do this if you were going to do it early in 2014 anyway. It’s stupid to buy something you don’t need just to get a tax deduction.

5. Accelerate expenses and defer revenue in your business – if possible without breaking the law!

6. Sell losing stocks – harvest those losses to offset gains, but be careful of the wash sale rules

7. Give to charity – giving appreciated stock is especially tax efficient!

8. Have a tax professional project your situation – look, tax planning is like a puzzle sometimes, especially if you have a business, rental properties, and investments. Have someone that knows what they are doing project your situation before year-end and give you suggestions on what to do. If they do not or will not do this for you, find someone that will (like us!!). It could save you thousands of dollars!

So, these are some simple things you can do before the end of 2013 to save taxes, but, of course, not all of them may apply to you so definitely talk to your tax professional to see what makes sense. Heck, there may be 5 more things I have not included above that may help you save even more!

Mat Hultquist, CPA